Commercial Lending Software

Expand into a commercial lending platform

Easy loan changes.

- Loan extensions

- Loan restructures that keep all loan history

- Rate modifications

Complex loan products.

- Servicing fees

- Lines of credit (revolving and non)

- Draw fees

- Commitments

Participated loans.

- Sub-accounting for participations

- Disbursements

Lending Software that Provides Powerful Flexibility Throughout the Loan Lifecycle

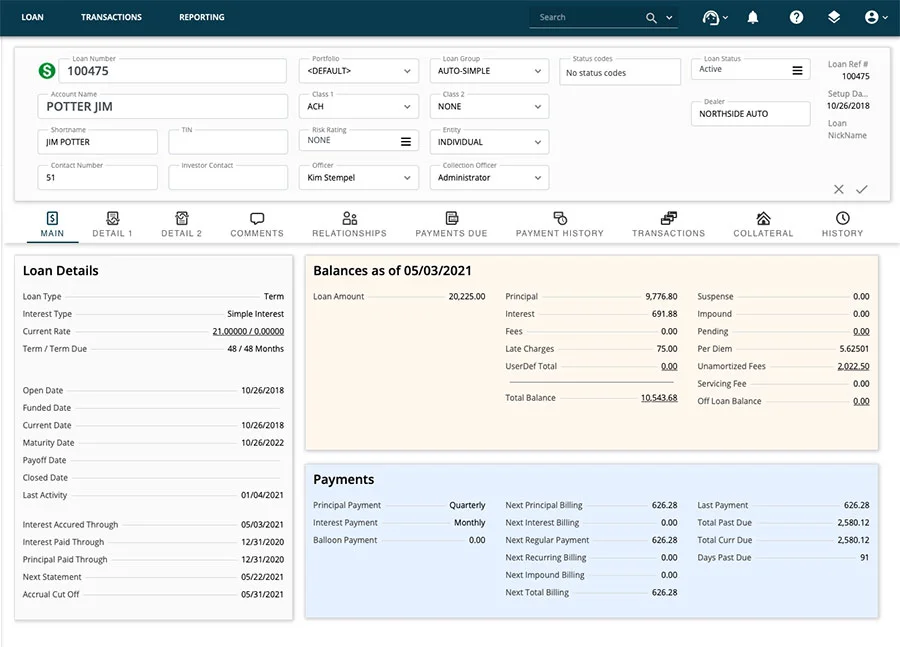

Granular configuration for creating loan products and clear visibility into your loan and borrower data are just the basics.

Loan origination

Originate, underwrite, verify, and fund loans in one place. Accept applications, create loan approval workflows, run and parse credit, build rules, create and store documents.

Learn more

Loan Servicing

Accept payments online, by phone and via ACH. Generate statements and letters for online viewing or print, or email. Track and manage collateral, escrow, payoffs.

Learn more

Default management

Improve your collection rates on delinquent accounts. Generate queues based on any triggers. Automate promises to pay, kept and broken promises. Automate handling of bankruptcies and other legal actions.

Business analysis

Segment borrower and loan performance any way you want. Generate management reports for any aspect of the lending business. Direct interfaces to any GL system, export at any level of detail or summary.

Learn more

See the features you care about and get answers to all your questions.

About Nortridge Commercial Loan Software

Implement and onboard successfully. And dare we say, faster?

If you’ve been in the industry long enough, you’ll know that implementing software across the organization is a daunting task.

That’s where our consulting and training teams come in.

Our teams have a track record of successful implementations. Making it faster to onboard your entire lending organization and implement quickly.

A fantastic support team.

“Good support, good tools like the videos and great training via WebEx. Our reps have been great.”

Plenty of resources to help make the most out of our lending software.

What’s better than software documentation? – Documentation that gets better every time a customer calls with a feature question. Over time we have developed, yes, the classic UserGuide, but also a handful of additional resources for the do-it-yourself fans: